Audit Support

Navigate Audits with Confidence with Expert Audit Support Services!

Audit Support

At Health Care Protectors, we offer specialized Audit Support services designed to guide you through the complexities of various types of audits, including insurance coverage requirements, Department of Labor (DOL) audits, financial audits, compliance audits, and more. Our team, including experts from our CPA arm, CPA CLINICS, is dedicated to providing comprehensive support, ensuring compliance and minimizing the stress associated with audits.

Why Audit Support Services Matter

Facing an audit can be daunting for any business or individual. Proper audit support ensures that you are well-prepared, compliant with regulations, and equipped to handle any inquiries from regulatory authorities. Here are several reasons why you should consider our Audit Support services:

- Expert Guidance: Receive professional guidance from experienced CPAs to navigate the audit process.

- Compliance: Ensure compliance with all relevant regulations to avoid penalties and fines.

- Documentation: Maintain accurate and organized documentation to support your audit requirements.

- Representation: Benefit from expert representation during interactions with regulatory authorities.

- Peace of Mind: Minimize stress and uncertainty with thorough preparation and support.

Types of Audits We Support

- Internal Audits

- Purpose: Internal audits are conducted by an organization’s own internal audit team to assess the effectiveness of internal controls, risk management, and governance processes.

- Support Services: Assistance with planning and conducting internal audits, evaluating internal controls, identifying areas for improvement, and developing recommendations.

- Financial Audits

- Purpose: Financial audits are conducted by external auditors to evaluate the accuracy and completeness of an organization’s financial statements.

- Support Services: Preparation of financial records, assistance with audit requests, representation during auditor interactions, and post-audit support to address findings.

- Compliance Audits

- Purpose: Compliance audits assess whether an organization is adhering to applicable laws, regulations, and internal policies.

- Support Services: Ensuring compliance with regulatory requirements, preparing documentation, and representing the organization during the audit.

- Tax Audits

- Purpose: Tax audits are conducted by tax authorities to verify the accuracy of tax returns and compliance with tax laws.

- Support Services: Preparation and review of tax records, representation during audit interactions, and assistance with addressing audit findings.

- Operational Audits

- Purpose: Operational audits evaluate the efficiency and effectiveness of an organization’s operations, processes, and procedures.

- Support Services: Assessment of operational processes, identification of inefficiencies, and recommendations for improvement.

- Department of Labor (DOL) Audits

- Purpose: DOL audits ensure compliance with labor laws and regulations, including wage and hour compliance, employee benefits, workplace safety, and more.

- Support Services: Preparing documentation, ensuring compliance with DOL regulations, representing you during the audit, and addressing any findings or recommendations.

- Insurance Coverage Audits

- Purpose: Insurance coverage audits assess compliance with insurance requirements, including health insurance, workers’ compensation, liability coverage, and more.

- Support Services: Ensuring that your business meets all insurance coverage requirements, preparing documentation, representing you during the audit, and addressing any findings or recommendations.

- Performance Audits

- Purpose: Performance audits assess the effectiveness and efficiency of an organization’s programs and activities.

- Support Services: Evaluating program performance, identifying areas for improvement, and developing recommendations for enhancing efficiency.

Primary Healthcare Services

Your Partner in Comprehensive Virtual Primary Healthcare Solutions!

Medical Billing

Take control of your financial future with our specialized accounting services

Social Media Marketing

Elevate Your Brand's Voice – Social Media Marketing That Connects, Engages, and Grows!

Website Development

Transform Your Vision into Reality – Stunning, Functional Websites Built for Success!

Benefits of Using Our Audit Support Services

Expertise of Certified Public Accountants (CPAs):

- Our CPA CLINICS team comprises highly qualified Certified Public Accountants with extensive knowledge and experience in handling various types of audits. Their expertise ensures that you receive professional guidance throughout the audit process.

Comprehensive Audit Support:

- We offer a wide range of audit support services to meet the unique needs of your business or personal situation. Our comprehensive approach ensures that all aspects of your audit are handled with precision and care.

Accuracy and Compliance:

- Accuracy is at the core of our audit support services. We ensure that all documentation is accurate and complies with the latest regulations, minimizing the risk of errors and penalties.

Thorough Preparation:

- Our thorough preparation process ensures that you are well-prepared for the audit. We review your records, identify potential issues, and address them proactively.

Representation and Communication:

- We provide expert representation during interactions with regulatory authorities. Our CPAs communicate on your behalf, addressing any inquiries and providing the necessary documentation.

Post-Audit Support:

- We offer post-audit support to help you address any findings or recommendations from the audit. Our team assists in implementing any required changes to ensure ongoing compliance.

Detailed Reporting and Insights:

- We provide detailed reports that offer valuable insights into the audit process, potential issues, and areas for improvement. These insights help you make informed decisions and enhance your compliance.

Ongoing Support and Advisory:

- Our CPAs are available year-round to provide ongoing support and advisory services. Whether you have questions about regulations, need assistance with implementing audit recommendations, or require guidance on compliance, we are here to help.

Why Customers Choose Us

Experienced and Qualified Team:

- Our team of CPAs and audit experts brings extensive experience and qualifications to the table. We understand the complexities of audits and provide expert solutions to meet your needs.

Personalized Service:

- We take the time to understand your specific audit situation and customize our services to meet your unique needs. Our personalized approach ensures that you receive the support and solutions that work best for you.

Reliability and Trust:

- Our clients trust us to handle their audits accurately and efficiently. We have built a reputation for reliability and excellence, and we are committed to maintaining the highest standards in audit support.

Proactive Approach:

- We take a proactive approach to audit support, ensuring that potential issues are identified and addressed before they become problems. Our proactive strategies help you stay compliant and avoid penalties.

Advanced Technology:

- We use advanced software and technology to streamline the audit process and ensure accuracy. Our technology-driven approach enhances efficiency and reduces the risk of errors.

Comprehensive Solutions:

- From pre-audit preparation to post-audit support, we offer comprehensive solutions that cover all aspects of audit management. Our all-in-one approach simplifies the audit process and provides peace of mind.

Our Approach

At Health Care Protectors, we adopt a meticulous and client-focused approach to audit support services:

Pre-Audit Preparation:

- Process: Our process starts with a thorough review of your financial records and audit requirements. We identify potential issues and address them proactively to ensure that you are well-prepared for the audit.

- Collaboration: We collaborate closely with your finance team to ensure that all documentation is accurate and up-to-date.

Representation and Communication:

- Expert Representation: We provide expert representation during interactions with regulatory authorities. Our CPAs communicate on your behalf, addressing any inquiries and providing the necessary documentation.

- Clear Communication: We ensure clear and consistent communication throughout the audit process, keeping you informed and updated at every stage.

Compliance Assurance:

- Regulatory Updates: Keeping up with regulations is essential for avoiding penalties and fines. Our team stays updated with the latest changes and ensures that all documentation complies with these standards.

- Documentation and Record-Keeping: We maintain accurate and complete documentation of all audit-related activities, ensuring that records are readily available for review.

Post-Audit Support:

- Addressing Findings: We help you address any findings or recommendations from the audit. Our team assists in implementing any required changes to ensure ongoing compliance.

- Continuous Improvement: We identify areas for improvement and provide recommendations to enhance your compliance and financial management.

Meet Our Doctors

Dr. Faika Khan

Dr. John Muney

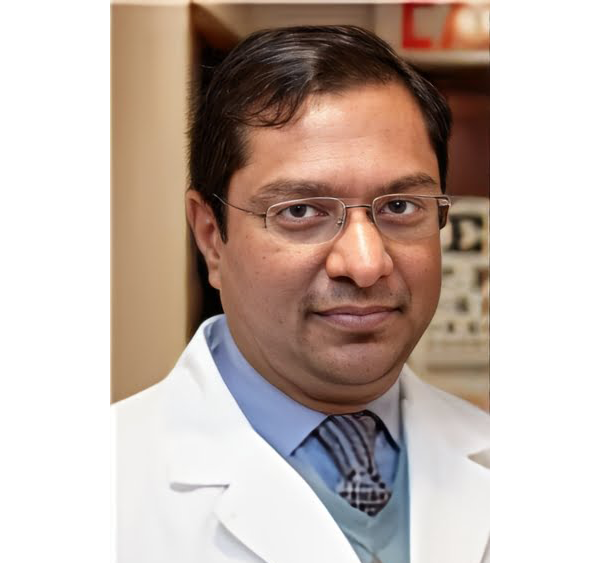

Dr. Ravindra Kashyap

Dr. Valerie Brutus

Your questions answered

Frequently Asked Questions (FAQs)

What are Audit Support Services?

Audit Support Services involve providing guidance, preparation, and representation for various types of audits, including insurance coverage requirements, DOL audits, and regulatory audits. It ensures compliance with regulations and helps address any inquiries from authorities.

Why is thorough audit preparation important?

Thorough audit preparation helps you identify and address potential issues before the audit. It ensures that all documentation is accurate and compliant, minimizing the risk of penalties.

How do you ensure compliance with regulations?

Our team stays updated with the latest changes in regulations. We ensure that all documentation complies with these standards, minimizing the risk of penalties and fines.

What kind of reporting can we expect from your audit support services?

We provide detailed reports that include insights into the audit process, potential issues, and areas for improvement. These reports help you make informed decisions and enhance your compliance.

How do your services help reduce audit-related penalties?

By ensuring accurate documentation and proactive preparation, we help reduce audit