Payroll

Streamline Your Payroll Processes with Expert Payroll Services!

Payroll

Comprehensive Payroll Services

At Health Care Protectors, we offer specialized Payroll services designed to ensure accurate and efficient payroll management for businesses of all sizes. Our team, including experts from our CPA arm, CPA CLINICS, is dedicated to handling all aspects of payroll, allowing you to focus on your core business operations.

Why Payroll Services Matter

Efficient payroll management is crucial for any successful business. Proper payroll processes ensure compliance, minimize errors, and optimize employee satisfaction. Here are several reasons why you should consider our Payroll services:

- Accurate Payroll Processing: Ensuring precise payroll calculations and timely payments.

- Compliance: Adhering to labor laws and tax regulations to avoid penalties and fines.

- Employee Satisfaction: Maintaining employee satisfaction through timely and accurate payments.

- Time Savings: Saving time and resources by outsourcing payroll management to experts.

- Revenue Optimization: Maximizing operational efficiency through streamlined payroll processes.

Benefits of Using Our Payroll Services

Expertise of Certified Public Accountants (CPAs):

- Our CPA CLINICS team comprises highly qualified Certified Public Accountants with extensive knowledge and experience in payroll management. Their expertise ensures that your payroll is handled accurately and efficiently.

Comprehensive Payroll Solutions:

- We offer a wide range of payroll services to meet the unique needs of your business. Our comprehensive approach ensures that all aspects of your payroll are handled with precision and care.

Accuracy and Compliance:

- Accuracy is at the core of our payroll services. We ensure that all payroll calculations are correct and comply with the latest labor laws and tax regulations, minimizing the risk of errors and penalties.

Timely Payroll Processing:

- Our efficient payroll processing ensures that your employees are paid on time, every time. This helps maintain employee satisfaction and reduces the risk of payroll-related issues.

Customized Payroll Strategies:

- We develop customized payroll strategies tailored to your business needs. Our CPAs work closely with you to identify opportunities for payroll efficiency and cost savings.

Payroll Tax Management:

- We handle all aspects of payroll tax management, including tax calculations, withholdings, and filings. Our proactive approach ensures that your payroll taxes are accurate and submitted on time.

Payroll Tax Filing:

- Quarterly Reports: We file quarterly payroll tax reports, including Form 941 (Employer’s Quarterly Federal Tax Return) and state-specific quarterly tax returns.

- Annual Reports: We handle annual payroll tax filings, including Form 940 (Employer’s Annual Federal Unemployment (FUTA) Tax Return), Form W-2 (Wage and Tax Statement) for employees, and Form W-3 (Transmittal of Wage and Tax Statements) to the Social Security Administration.

Employee Benefits Administration:

- We manage employee benefits, including health insurance, retirement plans, and other perks. Our team ensures that benefits are administered accurately and in compliance with regulations.

Detailed Reporting and Insights:

- We provide detailed payroll reports that offer valuable insights into your payroll expenses, tax liabilities, and overall financial health. These insights help you make informed decisions and optimize your payroll processes.

Ongoing Support and Advisory:

- Our CPAs are available year-round to provide ongoing support and advisory services. Whether you have questions about payroll regulations, need assistance with payroll tax audits, or require guidance on employee compensation, we are here to help.

Medical Billing

Take control of your financial future with our specialized accounting services

Audit Support

Let us handle the numbers, so you can focus on growth – Contact us now for accounting services.

Google Ads Marketing

Explore our full range of healthcare solutions – Click here for more details!

Why Customers Choose Us

Experienced and Qualified Team:

- Our team of CPAs and payroll experts brings extensive experience and qualifications to the table. We understand the complexities of payroll management and provide expert solutions to meet your needs.

Personalized Service:

- We take the time to understand your business and customize our services to meet your unique needs. Our personalized approach ensures that you receive the support and solutions that work best for you.

Reliability and Trust:

- Our clients trust us to handle their payroll accurately and efficiently. We have built a reputation for reliability and excellence, and we are committed to maintaining the highest standards in payroll management.

Proactive Approach:

- We take a proactive approach to payroll management, ensuring that potential issues are identified and addressed before they become problems. Our proactive strategies help you stay compliant and avoid penalties.

Advanced Technology:

- We use advanced payroll software and technology to streamline processes and ensure accuracy. Our technology-driven approach enhances efficiency and reduces the risk of errors.

Comprehensive Solutions:

- From payroll processing to tax management and benefits administration, we offer comprehensive solutions that cover all aspects of payroll management. Our all-in-one approach simplifies your payroll processes and saves you time and resources.

Our Approach

At Health Care Protectors, we adopt a meticulous and client-focused approach to payroll services:

Accurate Payroll Processing:

- Process: Our process starts with the accurate calculation of payroll based on employee hours, salaries, and benefits. This involves a detailed review of all relevant information and the use of advanced payroll software to ensure that calculations are accurate.

- Collaboration: We collaborate closely with your HR and finance teams to ensure that all payroll-related information is accurate and up-to-date.

Timely Payroll Processing:

- Importance: Ensuring that payroll is processed on time is crucial for maintaining employee satisfaction and compliance. We utilize advanced payroll software to expedite the processing and ensure that payments are made on time.

- Monitoring: Our team continuously monitors the payroll process to ensure that all payments are made accurately and on schedule.

Compliance Assurance:

- Regulatory Updates: Keeping up with labor laws and tax regulations is essential for avoiding penalties and fines. Our team stays updated with the latest changes and ensures that all payroll practices comply with these standards.

- Documentation and Record-Keeping: We maintain accurate and complete documentation of all payroll-related activities, ensuring that records are readily available for audits and inspections.

Detailed Reporting:

- Financial Health: Transparency and insight are key to effective financial management. We provide detailed payroll reports that include information on payroll expenses, tax liabilities, and employee benefits.

- Actionable Insights: We identify trends and patterns in the data, offering actionable insights to help you improve your payroll processes and enhance financial performance.

Payroll Tax Management:

- Tax Calculations and Filings: We handle all aspects of payroll tax management, including calculating tax withholdings, filing payroll tax returns, and ensuring timely payments to tax authorities.

- Compliance: Our proactive approach ensures that your payroll taxes are accurate and comply with all regulatory requirements.

Employee Benefits Administration:

- Benefits Management: We manage employee benefits, including health insurance, retirement plans, and other perks. Our team ensures that benefits are administered accurately and in compliance with regulations.

- Enrollment and Updates: We handle the enrollment of employees in benefit programs and ensure that any changes or updates are processed accurately.

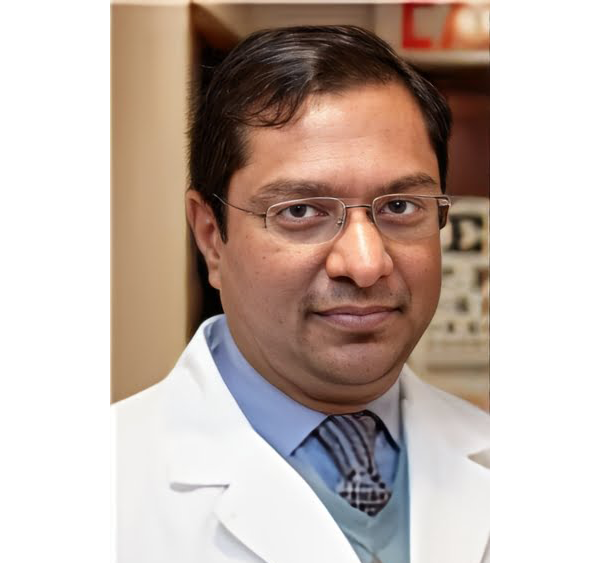

Meet Our Doctors

Dr. Faika Khan

Dr. John Muney

Dr. Ravindra Kashyap

Dr. Valerie Brutus

Your questions answered

Frequently Asked Questions (FAQs)

What are Payroll Services?

Payroll Services involve managing all aspects of payroll, including calculating employee pay, withholding taxes, and ensuring timely payments. It ensures compliance with labor laws and tax regulations.

Why is timely payroll processing important?

Timely payroll processing helps maintain employee satisfaction, ensures compliance with payroll deadlines, and reduces the risk of payroll-related issues.

How do you ensure compliance with labor laws and tax regulations?

Our team stays updated with the latest changes in labor laws and tax regulations. We ensure that all payroll practices comply with these standards, minimizing the risk of penalties and fines.

What kind of reporting can we expect from your payroll services?

We provide detailed payroll reports that include information on payroll expenses, tax liabilities, and employee benefits. These reports offer valuable insights into your financial health and help you make informed decisions.

How do your services help reduce payroll errors?

By using advanced payroll software and ensuring accurate calculations, we help reduce payroll errors. Our proactive approach ensures that all payroll-related information is accurate and up-to-date.

What is the importance of customized payroll strategies?

Customized payroll strategies help optimize payroll processes and identify opportunities for cost savings. They are tailored to meet the unique needs of your business, ensuring efficiency and compliance.

How do you handle employee benefits administration?

We manage employee benefits, including health insurance, retirement plans, and other perks. Our team ensures that benefits are administered accurately and in compliance with regulations.

How do we get started with Health Care Protectors' Payroll Services?

Getting started is simple. Just contact us through our website or give us a call. Our team will guide you through the process and customize a payroll plan that meets your business needs.

Ready to streamline your payroll processes and achieve your business goals? Contact Health Care Protectors today to learn more about our expert Payroll services provided by our CPA arm, CPA CLINICS, and how we can help you optimize your operations and compliance.