Tax Preparation and Filing

Optimize Your Finances with Expert Tax Strategy, Preparation, and Filing Services!

Tax Preparation

At Health Care Protectors, we offer specialized Tax Strategy, Preparation, and Filing services designed to streamline your tax processes and maximize your financial benefits. Our Certified Public Accountant (CPA) firm, CPA CLINICS, is honored by IRS as an Authorized Tax Counseling Firm and is staffed with a team of CPAs who bring extensive expertise and experience to the table. Our team is dedicated to ensuring effective tax strategies, accurate tax preparation, and efficient filing, allowing you to focus on your personal and business financial goals.

Why Tax Strategy, Preparation, and Filing, Matter

Efficient tax preparation and filing are critical components of a successful financial plan. Proper tax strategies help reduce liabilities, ensure compliance, and optimize financial outcomes. Here’s why you should consider our Tax Strategy, Preparation, and Filing services:

- Tax Strategies: Develop tailored tax strategies to minimize liabilities and maximize savings.

- Accurate Tax Preparation: Ensure precise tax preparation and entry to minimize errors and optimize benefits.

- Timely Filing: Expedite the filing process to reduce penalties and maximize returns.

- Compliance: Ensure compliance with tax laws and regulations to avoid penalties and fines.

- Revenue Optimization: Maximize financial benefits through efficient and accurate tax planning.

Benefits of Filing with CPA CLINICS

Expertise of CPAs:

- Our CPA CLINICS team consists of highly qualified CPAs with extensive knowledge and experience in tax laws, regulations, and financial planning. Our expertise ensures that your tax returns are prepared accurately and efficiently.

Comprehensive Tax Services:

- From individual tax preparation to complex business tax filings, we offer a wide range of tax services to meet your needs. Our comprehensive approach ensures that all aspects of your taxes are handled with precision and care.

Personalized Tax Strategies:

- We develop customized tax strategies tailored to your unique financial situation. Our CPAs work closely with you to identify opportunities for tax savings and optimize your financial outcomes.

Accuracy and Compliance:

- Accuracy is at the core of our tax preparation process. We ensure that all entries are correct and comply with the latest tax laws and regulations, minimizing the risk of errors and penalties.

Proactive Tax Planning:

- Our proactive approach to tax planning ensures that you are well-prepared for tax season. We review your financial situation regularly and adjust your tax strategies as needed to take advantage of any changes in tax laws.

Audit Support and Representation:

- If you are facing a tax audit, our CPAs provide comprehensive support and representation. We handle all aspects of the audit process, from preparing documentation to communicating with tax authorities.

Appeal and Refund Services:

- Our team assists in filing appeals and claims for tax refunds, ensuring that you receive the maximum benefits. We handle the entire process, from submitting the appeal to following up with tax authorities.

Detailed Reporting and Insights:

- We provide detailed reports on your tax liabilities, deductions, credits, and overall financial health. These insights help you make informed decisions and optimize your tax planning further.

Ongoing Support and Advisory:

- Our CPAs are available year-round to provide ongoing support and advisory services. Whether you have questions about tax laws, need assistance with financial planning, or require guidance on business decisions, we are here to help.

Medical Billing

Take control of your financial future with our specialized accounting services

Audit Support

Let us handle the numbers, so you can focus on growth – Contact us now for accounting services.

Google Ads Marketing

Explore our full range of healthcare solutions – Click here for more details!

Our Approach

At Health Care Protectors, we adopt a meticulous and client-focused approach to tax strategy, preparation, and filing:

Tax Strategies:

- Customized Plans: We develop tailored tax strategies that align with your financial goals. Our strategies include maximizing deductions, optimizing retirement contributions, managing capital gains, and more.

- Long-Term Planning: Our tax strategies are designed to provide long-term benefits, ensuring that you achieve your financial objectives. By planning ahead, we help you minimize liabilities and maximize savings.

- Proactive Approach: We proactively review and adjust your tax strategies as needed to ensure that you take advantage of any changes in tax laws and regulations.

Accurate Tax Preparation:

- Process: Our process starts with the careful and precise preparation of taxes based on your financial information. This involves a detailed review of all relevant documents and the use of advanced tax software to ensure that the entries are accurate. Accurate tax preparation minimizes errors that can lead to penalties and delays in refunds.

- Collaboration: We collaborate closely with you to understand your financial situation and ensure that every deduction and credit is correctly documented.

Timely Filing:

- Importance: The speed at which tax returns are filed can significantly impact your financial outcomes. We utilize advanced tax software to expedite the filing process. By filing returns promptly, we reduce the risk of penalties and maximize your returns. Timely filing also ensures that you comply with tax deadlines, preventing any legal issues.

- Monitoring: Our team continuously monitors the filing process to ensure that returns are filed within deadlines, reducing the risk of penalties due to late submissions.

Compliance Assurance:

- Regulatory Updates: Keeping up with tax laws and regulations is essential for avoiding penalties and fines. Our team stays updated with the latest changes in tax laws and ensures that all tax practices comply with these standards, minimizing the risk of non-compliance. This includes adhering to IRS regulations and guidelines for accurate tax preparation and filing.

- Documentation and Record-Keeping: We maintain accurate and complete documentation of all tax-related activities, ensuring that records are readily available for audits and inspections.

Detailed Reporting:

- Financial Health: Transparency and insight are key to effective financial management. We provide detailed reports that include information on tax liabilities, deductions, credits, and more. These reports offer a comprehensive view of your financial health, helping you make informed decisions. The reports also highlight areas where improvements can be made, enabling you to optimize your tax planning further.

- Actionable Insights: We identify trends and patterns in the data, offering actionable insights to help you improve your financial strategies and enhance your tax outcomes.

Tax Audit Support:

- Audit Preparation: If you are facing a tax audit, we provide comprehensive support to navigate the process smoothly. This includes preparing all necessary documentation, representing you before tax authorities, and addressing any issues that arise.

- Compliance and Defense: Our team ensures that your tax returns are compliant with all regulations and defends your position during the audit process.

Appeal and Refund Services:

- Filing Appeals: If you disagree with a tax assessment, we assist in filing appeals and presenting your case to tax authorities.

- Claiming Refunds: We help you claim any tax refunds you are entitled to, ensuring that you receive the maximum benefits.

Bookkeeping Services:

- Accurate Record-Keeping: Maintain accurate financial records to streamline your tax preparation process. Our bookkeeping services ensure that all transactions are recorded correctly, providing a solid foundation for your tax filings.

Statistics and Impact

Studies show that effective tax preparation and filing can lead to a 20-30% increase in tax savings for individuals and businesses. Additionally, implementing tailored tax strategies can result in a 25% reduction in tax liabilities and a significant improvement in financial outcomes. Effective tax planning and compliance further enhance financial stability and long-term success.

By ensuring accurate tax preparation and filing, along with developing customized tax strategies, we help you achieve your financial goals and maximize your savings.

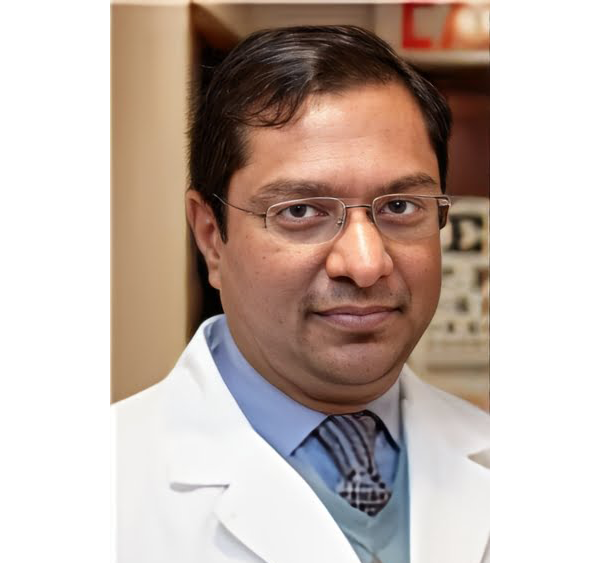

Meet Our Doctors

Dr. Faika Khan

Dr. John Muney

Dr. Ravindra Kashyap

Dr. Valerie Brutus

Your questions answered

Frequently Asked Questions (FAQs)

What is Tax Preparation and Filing?

Tax Preparation and Filing involve preparing and submitting tax returns accurately and on time. It ensures compliance with tax laws and maximizes financial benefits.

Why is timely tax filing important?

Timely tax filing helps avoid penalties, ensures compliance with tax deadlines, and maximizes your returns. Promptly filed returns are processed faster, leading to quicker refunds.

How do you ensure compliance with tax laws?

Our team stays updated with the latest changes in tax laws and regulations. We ensure that all tax practices comply with these standards, minimizing the risk of penalties and fines.

What kind of reporting can we expect from your tax services?

We provide detailed reports that include information on tax liabilities, deductions, credits, and more. These reports offer valuable insights into your financial health and help you make informed decisions.

How do your services help reduce tax liabilities?

By developing tailored tax strategies and maximizing deductions, we help reduce your tax liabilities. Our proactive approach ensures that you take advantage of all available tax benefits.

What is the importance of tax strategies in financial planning?

Tax strategies are essential for minimizing tax liabilities and maximizing savings. They provide long-term benefits and align with your financial goals, ensuring that you achieve your objectives.

How do you handle tax audit support?

If you’re facing a tax audit, we provide comprehensive support to navigate the process smoothly. This includes preparing documentation, representing you before tax authorities, and addressing any issues that arise.

How do we get started with Health Care Protectors' Tax Preparation and Filing services?

Getting started is simple. Just contact us through our website or give us a call. Our team will guide you through the process and customize a tax plan that meets your needs.

Ready to optimize your finances and achieve your financial goals? Contact Health Care Protectors today to learn more about our expert Tax Preparation, Filing, and Strategy services provided by our CPA arm, CPA Clinics, and how we can help you maximize your savings and compliance.